A Social Security Number (SSN) or Individual Tax Identification Number (ITIN) is needed to facilitate payment for scholarships, fellowships, employment in the U.S., and to file a U.S. tax return. If you are not eligible to apply for a SSN, you may need to request an ITIN in order to receive tax treaty benefits and to file a U.S. tax return.

Social Security Number

To be eligible to apply for a Social Security Number (SSN), international students and scholars are typically required to provide evidence of both employment and work authorization. Click on the categories below for more information on Social Security Number eligibility and required documentation. Not every student is eligible for a Social Security Number. If you have questions about your eligibility, please contact OISS.

Please note that while SSA has confirmed that they will accept electronically issued I-20s (as long as they are printed and hand signed by the student), most other supporting documentation, including letters, must have original, hand written signatures in ink.

- F-1/J-1 Students working on-campus

-

To be eligible for an SSN, F-1 and J-1 students must meet all the following requirements:

- Student is currently enrolled full-time, or is approved for part-time enrollment.

- Student has checked in with OISS and has been registered in SEVIS at least 2-3 prior. (This requirement applies only to new students who wish to apply for SSN right at the start of their academic program. For questions regarding SEVIS registration, please contact OISS.)

- Student has secured on-campus employment. (Please note that fellowships are not considered employment for the purpose of being eligible for SSN.)

- The on-campus job start date is no more than 30 days into the future.

- The on-campus employment is ongoing. Please note that once the position ends, the student is no longer eligible to apply for SSN so it's very important to apply as early as possible.

For more information, please see the handout Social Security Number Procedures for F-1 and J-1 Students.

If all requirements have been met, please follow these steps:

- Request on-campus employment supervisor to complete the Employment Verification Form (link and instructions for completing the form available in the section below!)

- F-1 students: Complete a Statement of Understanding for F-1 Student On-Campus Employment.

J-1 students: All on-campus employment for J-1 students must be authorized by OISS in SEVIS before you begin work! Please see https://oiss.rice.edu/studentwork and the J-1 Student On-Campus Employment Authorization Form for more information. - Submit completed and signed Employment Verification Form and Statement of Understanding to OISS at http://bit.ly/oissdocs to request SSN Letter of Support, which will verify that you are authorized for this employment.

List of documents needed when visiting the Social Security Office

- I-20/DS-2019

- Passport

- Most recent I-94 record

- Original Employment Verification Form completed and signed by on-campus employment supervisor (wet ink signature required)

- Original SSN Letter of Support issued by OISS (wet ink signature required)

Please also see section "Applying for the Social Security Number" below.

- For hiring department: Link and instructions for On-Campus Employment Verification Form

-

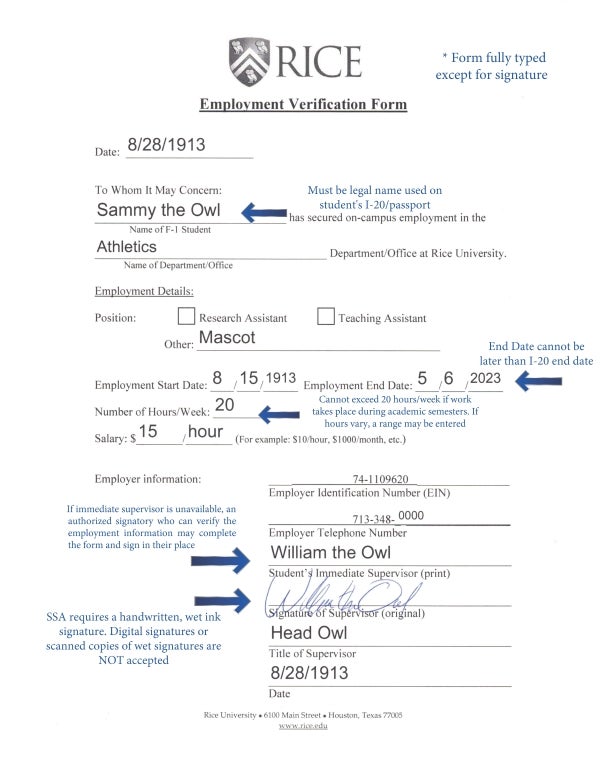

The Employment Verification Form should be completed by the immediate supervisor or an authorized signatory who can verify the employment information.

Important: Per Social Security Administration (SSA) requirements the form must be typed by the employer and printed for an original signature in ink. A scanned copy of a wet signature is not sufficient for SSA.When completing the form, please consider the following:

• Name of student should match all legal documents, including passport, I-20, etc. Nicknames or other unofficial names should not be used so that the form matches the immigration documents the student will present to SSA.

• Position title should be descriptive and accurate. "Graduate student" or "Fellow" is not an acceptable position title, since receiving a fellowship does not make a student eligible for SSN.

• Employment Start and End Dates should be accurate according to what is expected at the time the form is completed. If the position is expected to continue throughout the student's degree program, the End Date cannot be later than the student's current I-20 expiration date.

• Students are eligible to work no more than 20 hours/week during the academic semesters, but may work full-time during official school breaks. If the employment dates include academic semesters, Number of Hours/Week cannot exceed 20. If hours vary, you may enter a range on the Employment Verification Form.

• A wet signature is required from the supervisor or authorized signatory (the rest of the form should be typed). SSA does not accept digital signatures or copies/scans of wet signatures, the student must present the original, hand signed form when applying for their SSN.

Here is an example of a completed Employment Verification Form:

Click here to download a blank Employment Verification Form.

- F-1/J-1 Students working off-campus

-

To be eligible for an SSN, F-1 and J-1 students must meet all the following requirements:

- Student is currently enrolled full-time, or is approved for part-time enrollment.

- Student has checked in with OISS and has been registered in SEVIS at least 2-3 weeks prior. (This requirement applies only to new students who wish to apply for SSN right at the start of their academic program. For questions regarding SEVIS registration, please contact OISS.)

- Student has secured authorization for off-campus employment (i.e., CPT/Academic Training). For more information, please see our Student Employment webpage.

- The CPT or Academic Training start date is no more than 30 days into the future.

- The CPT or Academic Training is ongoing. Please note that once the authorization ends, the student is no longer eligible to apply for SSN so it's very important to apply as early as possible.

List of documents needed when visiting the Social Security Office:

- I-20/DS-2019 indicating the CPT/Academic Training authorization

- Passport

- Most recent I-94 record

- Although SSA does not officially require you to provide a copy of your offer letter from the employer, OISS recommends that you bring it with you just in case as additional documentation.

Please also see section "Applying for the Social Security Number" below.

- J-1 Scholars

-

J-1 scholars are eligible to apply for an SSN 2-3 weeks after they have attended the immigration check-in appointment with OISS.

For more information, please see the handout Social Security Number Procedures for Scholars.List of documents needed when visiting the Social Security Office:

• DS-2019

• Passport

• Most recent I-94 record

• Offer letter from Rice**

**A wet ink signature is required on the offer letter! Per SSA, they “[accept] a legible photocopy or duplicate letter...; however, the sponsor representative must certify the photocopy by signing and dating the sponsor letter with a wet signature.” Please work with your academic department to secure this additional signature!

Please also see section "Applying for the Social Security Number" below. - Students and Scholars on other visas

-

If you have a valid EAD card issued by USCIS, you are automatically eligible to apply for a Social Security Number. Otherwise eligibility depends on visa type and other circumstances. Not every student is eligible for an SSN. If you have questions about your eligibility, please contact OISS.

- Applying for the Social Security Number

-

To apply for the Social Security Number, you must visit a Social Security Office in person with all the required documents (please see categories above for a list of applicable documentation). You are welcome to visit any SSA location. Maps to the SSA office closest to Rice campus are available at OISS (or online), or you may look up other SSA offices at http://www.socialsecurity.gov/locator.

Before visiting SSA, please visit https://secure.ssa.gov/ossnap/public/landingOSsnap to complete a pre-application form with your biographical and address information and schedule your appointment.

After applying in person, you will receive your Social Security Card in the mail typically within 2-4 weeks. Please note that while you may begin employment prior to receiving the Social Security Number, you must update the Payroll and/or HR office of your employer with that information upon receiving your SSN card.

F-1 and J-1 visa holders remain eligible for the Social Security Number only as long as your employment continues, so we recommend that you apply as early as possible. Keep your Social Security Card in a safe place with your personal records, don't carry it with you unless you need to provide it for a specific and legitimate purpose. The SSN that is issued for you will be your Social Security Number for the duration of your lifetime, even if you leave the U.S. and return several years later on a new visa status.

For more information, please see the Social Security Administration website at https://www.ssa.gov/ - Applying for a replacement Social Security Card

-

If you have lost your Social Security card and need a replacement, please note that the documentation and eligibility requirements are the same as for an initially issued SSN card (see above).

Social Security Numbers are issued for the duration of your lifetime, so the SSN on the new, replacement card will be the same as the SSN issued for you previously. If you remember the number, you may continue to use it even if you do not have the physical card.

Individual Taxpayer Identification Numbers (ITINs)

If you do not have a Social Security Number (SSN) and are not currently eligible for an SSN (i.e., you do not have employment), you will need to apply for an ITIN to receive tax treaty benefits and/or to file your U.S. tax return. If you are from a country that allows you to claim dependents on your U.S. tax return (Canada, Mexico, South Korea or India) or you are a resident alien for tax purposes and your dependent does not currently have an SSN and is not eligible for an SSN, then your dependent will also need to apply for an ITIN to be claimed on your tax return.

NOTE: If you are only required to file form 8843 for your U.S. tax return, then no SSN nor ITIN is required.

- ITIN process for F-1s and J-1s receiving Rice funding

-

Rice-sponsored F-1s and J-1s receiving a taxable scholarship, fellowship, or grant who are not eligible for a SSN and do not yet have an ITIN may be able to apply for an ITIN at OISS through a special provision in U.S. tax law. Please visit https://oiss.rice.edu/itin to learn more.

- General application process for ITIN

-

*For information on applying for an ITIN from outside the U.S., please see Sprintax's blogpost.

STEP 1: Prepare your tax return – In order to apply for an ITIN, you must have a valid reason, such as the need to file your U.S. tax return. This documentation is required as part of your application. You may use Sprintax to assist you in preparing your tax return and your ITIN application.

STEP 2: Obtain “No Employment Certification” letter from OISS – Please request this letter by phone or email. It will be prepared and ready for you on the following business day.

STEP 3: Gather the following documents and visit a certified acceptance agent or Taxpayer Assistance Center (TAC) in person (most require appointments). The agent will review your original immigration documents, certify them, return the originals to you and forward all documents including tax return forms to the IRS ITIN office.

NOTE: While it is possible to mail in your forms without visiting an approved agent, you would be required to send in your original documents. OISS does NOT recommend ever mailing your original immigration documents, as the risk of them getting lost is very high. You may seek a certified copy of your passport from your home country's consulate or embassy to mail to the IRS, but this would be the only circumstance in which you may bypass visiting a certified agent in person.

Documents (Click for complete list):- Completed IRS Form W-7 Application (Sprintax will prepare it for you)

- Completed tax return forms (including 8843, 1042NR-EZ, etc.)

- Original passport, visa, and I-94

- Original I-20 or DS-2019 form

- OISS letter for “No Employment Certification”

STEP 4: ITIN receipt – The IRS will mail you a letter assigning you your ITIN number within 6-8 weeks. The ITIN office will enter that information on the tax forms you submitted with your application and will forward your tax return forms to the proper tax processing unit to complete your tax return filing.

- ITIN Processing Locations – Acceptance Agents and Taxpayer Assistance Centers

-

Taxpayer Assistance Centers

Location Address Hours Contact Information Houston (SW)

8701 S. Gessner

Houston, TX 77074Monday - Friday; 8:30 a.m. - 4:30 p.m.

Services ProvidedOffice Information

281-721-7021

Make Appointment

844-545-5640Houston (SE)

8876 Gulf Freeway

Houston, TX 77017Monday - Friday; 8:30 a.m. - 4:30 p.m.

Services ProvidedOffice Information

281-721-7021

Make Appointment

844-545-5640Houston (NW)

12941 I45 N

Houston, TX 77060Monday - Friday; 8:30 a.m. - 4:30 p.m.

Services ProvidedOffice Information

713-209-5499

Make Appointment

844-545-5640Houston (Downtown)

**closest to Rice1919 Smith St.

Houston, TX 77002Monday - Friday; 8:30 a.m. - 4:30 p.m.

Services ProvidedOffice Information

281-721-7021

Make Appointment

844-545-5640Acceptance Agents can be found in Texas and around the world. Visit https://www.irs.gov/individuals/international-taxpayers/acceptance-agent-program to find one near you. Please note that some agents may charge a fee associated with their services, including tax form preparation, so be sure to inquire directly with the agent regarding any costs to you.