A U.S. bank account will make managing your finances a lot easier, so you should set one up as soon as you arrive. You can deposit your financial aid awards, loans and stipends, all of which may be paid to you by check, as well as money from home.

With most bank accounts, you can manage and make all of your bill payments online. In addition, most banks issue debit cards with a MasterCard or Visa emblem, which means you can use the card to make purchases against your account anywhere that accepts credit cards, including online and in stores. Carrying large amounts of cash can be dangerous and paying in cash doesn't leave much evidence behind to prove your payment in case of a dispute. Certainly, a bank account will make budgeting a lot easier.

- How Do I Choose a Bank and an Account?

-

Banks offer many different financial services. You may wish to compare the services and costs of several banks before choosing one at which to open an account. There are several banks in the Rice campus vicinity. However, a large number of Rice students choose to open an account at Chase since they have a branch close to campus (6560 Fannin Street, 800-935-9935) and the only two ATMs located on campus.

You may also want to consider Adro, where you can open an account already from outside the United States. To learn more about Adro and their services, please visit https://www.joinadro.com.

You will need a checking account for proper money management (for writing checks, online bill payment, debit/credit cards, etc.). If you have large amounts of money just sitting in your account, it may make sense to open a savings account as well. Investigate the accounts the bank has available, with an eye towards how much it could cost you to open and maintain the account (minimum balance requirement). Find out whether the bank offers interest on checking accounts, what the interest rate is on savings accounts and whether the account offers overdraft protection. - How Do I Open a Bank Account?

-

Even though lots of banks advertise that they allow new customers to open accounts online or by phone, as an international student, plan to open your account in person at a local branch. You do not fit neatly into a category for U.S. banks, and if you need additional services, it’s always good to have established a face to face relationship.

When you go, make sure you bring your passport and the funds you want to deposit. In addition, you should bring as many of the following documents or IDs as you have – although every bank has slightly different requirements, in addition to your passport you will likely need at least one of the following: your school ID, your state driver’s license or ID, your visa, your I-20 or DS-2019, and your I-94. If you are asked to provide proof a local mailing address, you may bring a signed lease or a letter you have received to that address.

You do not need to have a social security number (SSN) or an individual taxpayer identification number (ITIN) to open an account. If a bank asks for either, you may offer up your passport and any of the other ID documents mentioned above. For more information about SSN and ITIN application, please visit https://oiss.rice.edu/ssn.

You may also want to consider Adro, where you can open an account already from outside the United States. To learn more about Adro and their services, please visit https://www.joinadro.com. - Services Provided with a Bank Account

-

U.S. Banks provide a wide range of services for people who open a bank account. Some of the services that are typically provided include debit/credit cards, checks, wire transfers, and safe deposit boxes.

Debit cards are issued by U.S. Banks as a replacement for cash which allow you to pay for goods and services directly from your checking or savings account. You can ask your bank for one when you open an account.

Credit cards are similar to debit cards in that you can use them to pay for goods and services, but they do not take the payment directly from your checking or savings account. Instead, you get a bill at the end of every month that you must pay off. Most people acquire a credit card from a bank different than the one they have a checking and savings account. Once you obtain a credit card, it would be useful to start building your credit history. Read through the “What is a Credit Score?” section for more information on establishing a good credit history.

Before you arrive, find out from your bank at home how to wire money to the U.S., and how much it will cost in fees. After you have set up your new bank account, you can arrange the transfer by providing your home bank with your U.S. bank details. You will need to provide your account number, the U.S. bank's name and address, and the U.S. bank's ABA number. Wire transfers typically take between 2-5 days. Ask your home bank for a confirmation once the funds are wired.

You may use personal checks to pay for bills, rent, and other goods and services. Hopefully, you never accidentally write a check for more than you have in your account – but if you do, does the bank pay the check and just fine you, or do they refuse payment to the company you wrote the check to ("bounce" the check)? If so, both the company AND the bank will fine you and that adds up quickly! Ask how long it will take to "clear" a check – that is, how long from the time a check is deposited in your account until the time you are allowed to withdraw the funds. Typically wired funds are available immediately, but the "hold" on checks (local, out-of-state and foreign) varies by state and by bank, and can be several days to a week or even longer.

Most major U.S. banks offer "student checking" accounts and services designed specifically for students – here's a small sample:- https://www.chase.com/checking/student-checking

- https://www.wellsfargo.com/checking/student/

- https://www.bankofamerica.com/student-banking

- https://www.joinadro.com/

- Initial Money Needs on Arrival

-

You should evaluate your needs for the first few weeks of school – most schools suggest bringing about $2,500 in readily available funds. You can bring this amount in cash or traveler's checks, or better yet, bring your foreign bank card, after checking that it will work in U.S. ATMs, to access an account at home. All other money can be wired to your new U.S. bank account after you arrive. Remember, if you have a scholarship, assistantship or another form of employment, it will typically take a month or more to get your first payment, so make sure you have enough money to live during your first few weeks.

- Banks near Rice University

-

Banks near Rice University

Bank Hours (subject to change, please verify online) Bank of America

(http://www.bankofamerica.com/)

5214 Kirby Dr.

Houston, TX 77098

Phone: +1-713-535-6500Lobby: Mon-Fri 9am-5pm;

Sat 9am-2pm; Sun closed

Drive thru: Mon-Fri 9am-5pm;

Sat 9am-2pm; Sun closed

ATM: open 24 hoursChase Bank

(http://www.chase.com/)

6560 Fannin St.

Houston, TX 77030

Phone: +1-713-795-7312Lobby: Mon-Fri 9am-5pm;

Sat-Sun closed

ATM: open during branch hours

Two ATM locations on Rice campusTruist Bank

(https://www.truist.com/)

3730 Kirby Dr. Ste. 100

Houston, TX 77098

Phone: +1-713-345-1458Lobby: Mon-Fri 9am-5pm;

Sat-Sun closed

Drive thru: Mon-Fri 9am-5pm;

Sat-Sun closed

ATM: open 24 hoursWells Fargo

(http://www.wellsfargo.com/)

6551 Main St. Ste. F370

Houston, TX 77030

Phone: +1-713-285-2780Lobby: Mon-Fri 9am-5pm;

Sat-Sun closed

Drive thru: Mon-Thu 9am-5pm; Fri 9am-6pm

Sat 9am-1pm; Sun closed

ATM: open 24 hours - What is a Credit Score?

-

What it is

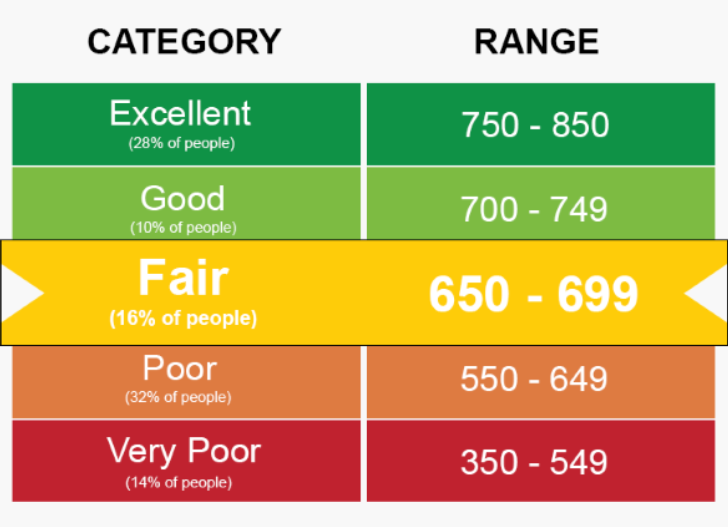

A credit score is a rating given to your financial history. It tells lenders how risky it would be to loan you money. It is a three-digit number between 350 and 850, with good scores ranging from about 700 and up.

How it works

In order to have a credit score you will need to build credit. The credit score is calculated by assessing several factors including how many accounts you have, the amount of available credit, percentage of credit used, your payment history, and the length of your credit history. The types of accounts you have (such as credit card, mortgage, etc.) also make an impact on your score.

What it is used for

Credit scores are used primarily by banks and insurance companies to determine your financial responsibility, including any risk factors associated with lending you money. The higher your score is, the better chance you have to get loans, credit cards, and well-priced insurance coverage.

How it affects YOU

Poor credit can cause issues with things like:

- Getting a credit card (the credit limit is low with very high APR)

- Getting a loan approval (loans have very high interest rates)

- Getting a reasonable insurance rate

- Leasing an apartment

- Applying for a mortgage

Ways to build a good credit score

- Opening a bank account: having a savings account and regularly transferring money to that account as well as setting up direct debit payments for your bills shows that you can be responsible for your finances.

- Utility Bills: Making regular payments on all your utilities (such as gas, electric, phone, internet, etc.) is another way to prove to lenders that you are responsible with your payments and will be a suitable applicant for a loan or credit option.

- Obtain a credit card: Using a credit card responsibly is a way to build and maintain a good credit score. Although it can be difficult to find a company that will allow you to open a credit card, it is possible to find companies that will allow you to open a credit card as an international student.

Credit building may not seem like a top priority when you first arrive in the U.S., but the sooner you start building good credit the better. Just as you are building a strong resume with your education at Rice in order to appeal to employers, a good credit score will appeal to lenders in the future.